We’ve mentioned before (here and here, for example), that you should be prepared for a long-term investment if you are getting into property. Here, let’s talk about why property pays off in the long term, but not necessarily in the short term.

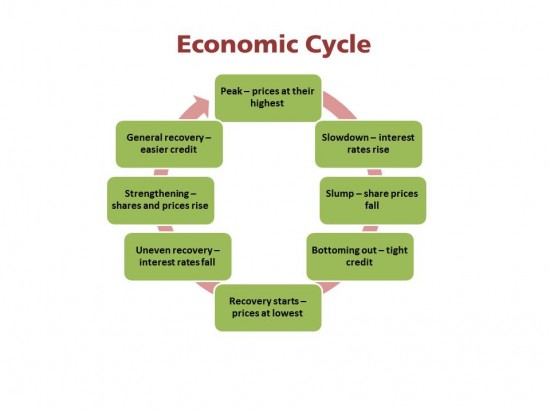

Economies work in cycles – large patterns of repeated growth and contraction that recur over and over through history. Individual parts of the wider economy may vary – some suburbs will remain untouched by a recession, for example, while others may even boom because of local factors. Some sectors may run counter to the trends, and some may do much worse than the rest of the economy. The timing of each cycle varies (sometimes as little as three to four years, often around 7 – 8 years, and sometimes longer), as does the pattern of recovery. On the whole, though, the economy runs through the ups and downs in a reasonably predictable pattern.

Obviously, it’s best to buy real estate at the bottom of the cycle, and sell at the top. Look at what happened to Bob:

Bob bought his first property in a new suburb just outside Sydney in November 2007. He got a floating mortgage and paid only 5% deposit. Unfortunately, as the economy started declining, so did house prices and Bob’s $500,000 property quickly became a $320,000 property. Luckily, his interest rates dropped from 6.75% to 4.9%. Unluckily, he could no longer afford to pay his mortgage when his company restructured and he lost his job in 2009. After he missed several payments, his bank decided they couldn’t risk waiting for Bob to get another job, and they foreclosed on his house.

Bob did find work contracting (for a great deal more money than he received as an employee), and he’s gradually rebuilding his financial reserves. He’s almost ready to get back into the property market, although he’s not sure of his chances of getting another mortgage. He’s been back to look at his old house, and it’s now on the market for $338,000.

Property, like any investment, has its ups and downs. There are a few key things to consider about Bob and the economic cycle:

- If Bob had properly assessed his affordability risks (say, if he had come to Majestic in the first place), he would have realised that buying in the 2007 market with only 5% deposit and no other reserves was a risky move. It may have been better for him to rent in Sydney and buy a property in an area with less volatile prices but higher yields for his first property.

- If Bob had managed to ride out the storm and hold on to his property, the price would have recovered. In fact, it’s likely to rise considerably over the next cycle because he bought in a good area with new amenities slated for construction in 2015.

- If Bob had bought at the low point of the cycle and held on to the property, he would have made a substantial profit by now, with an even greater profit on the horizon.

It’s often difficult to accurately pinpoint our position in the cycle, and, as we’ve said there are many variants that affect local conditions. Luckily, though, even if you get it wrong and buy at the very peak, if you can hold on and wait for another one or two cycles prices will recover if you’ve bought in a sound area. If you sell before then, though, you’ll likely make less profit or even lose money.

Talk to us. We’re constantly scanning the economic horizon. Mostly, though, we know a lot about affordability, what will make a good investment, and how to help you meet your investment needs in the long term.